IMPACT OF TRUMP TAX CUTS

Source: IRS

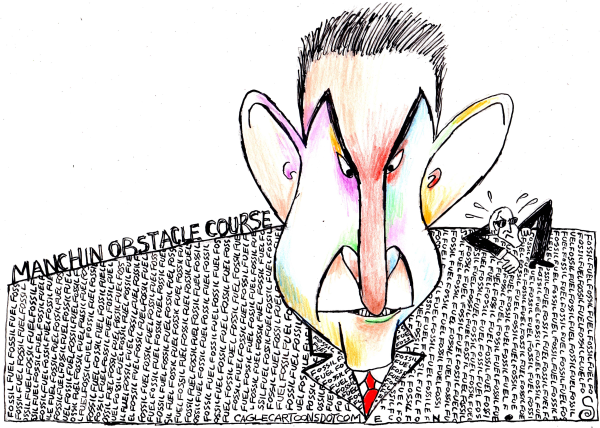

INCOME % REDUCTION To try to get back in the good graces of his Democratic colleagues, Senator Joe Manchin is floating the possibility that he might help kill the Trump tax cuts.

He claims that they are part of letting the rich off without "paying their fair share" of taxes.

But the Trump tax cuts were the most egalitarian in history as a new analysis by the IRS shows. The chart below measures the % reduction of taxes in each bracket. As you move up the list, the percent cut diminishes.

•

IMPACT OF TRUMP TAX CUTS

Source: IRS

INCOME % REDUCTION

• $15,000-$50,000 between 16% and 26%

• $50,000-$100,000 between 15% and 17%

• $199,000-$500,000 between 11% and 15%

• $500,000-$1 million = 9%

• Over $1 million = 6%

On the other hand, the Democratic proposal to raise the cap on State and Local Tax deductions (SALT) would disproportionately benefit the rich and the very rich — those whose mortgage interest comes to between $10,000 and $80,000 a year.

So the net effect of repealing the Trump tax changes would, in fact, be a massive subsidy to wealthy taxpayers. $15,000-$50,000 between 16% and 26%

• $50,000-$100,000 between 15% and 17%

• $199,000-$500,000 between 11% and 15%

• $500,000-$1 million = 9%

• Over $1 million = 6%

On the other hand, the Democratic proposal to raise the cap on State and Local Tax deductions (SALT) would disproportionately benefit the rich and the very rich — those whose mortgage interest comes to between $10,000 and $80,000 a year.

So the net effect of repealing the Trump tax changes would, in fact, be a massive subsidy to wealthy taxpayers.

(COMMENT, BELOW)

Dick Morris, who served as adviser to former Sen. Trent Lott (R-Miss.) and former President Clinton, is the author of 16 books, including his latest, Screwed and Here Come the Black Helicopters.

Contact The Editor

Contact The Editor

Articles By This Author

Articles By This Author